Table of Contents

RBI MPC opted to hold the repo rate at 6.5%. What does this mean for debt fund investors? Let’s see.

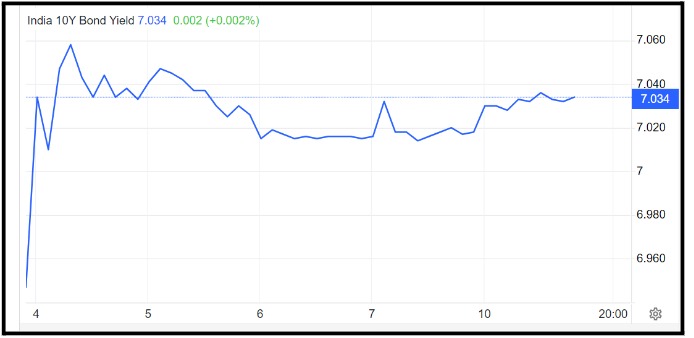

Investments in debt funds can be tricky, more so after the recent monetary policy announcement by the Reserve Bank of India (RBI). The RBI’s Monetary Policy Committee (MPC), in its sixth bi-monthly meeting dated June 7, 2024, has maintained the repo rate at 6.5% for the eighth time in a row. Following the policy announcement, India’s 10-year bond yield experienced a slight increase of 0.06%, reaching 7.02.

The move, among other announcements made during the meeting, has got the debt fund investors thinking about what their next move is. In this article, we’ll uncover the key highlights of the meeting, analyze the future outlook for interest rates, and guide debt fund investors on navigating this evolving scenario.

Key takeaways from the RBI MPC meeting

Here are some key takeaways from the recent meeting of the RBI’s Monetary Policy Committee:

Repo rate: The committee has opted to maintain the policy repo rate at 6.5%.

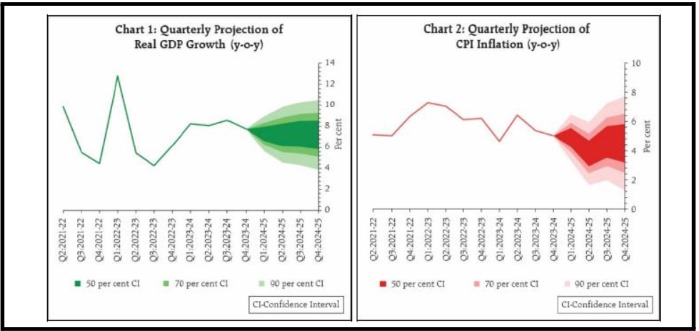

Inflation: The RBI remains committed to keeping inflation at 4%. Currently, it’s hovering around 5%. Assuming a normal monsoon, the projected inflation for the current fiscal year is 4.5%, with risks being evenly balanced.

GDP growth: The growth forecast for FY25 has been revised upwards to 7.2%, up from the earlier estimate of 7%. Moreover, India’s real GDP for FY24 is pegged at 8.2%.

Source: RBI

UPI Lite integration: The RBI has introduced the integration of UPI Lite with the e-mandate framework, enabling seamless small-value digital payments.

Digital Payments Intelligence Platform: The RBI plans to launch a digital payments intelligence platform to prevent digital fraud, thereby enhancing the security of online transactions.

Rates cut: Future outlook

The RBI is playing a waiting game. They have signaled their intention to hold off on easing monetary policy until inflation falls closer to their target of 4%. This suggests a cautious approach, prioritizing inflation control over immediate rate cuts.

The MPC meeting also highlighted the RBI’s independent stance. While they monitor global trends, like the US Federal Reserve’s actions, their decisions are primarily driven by India’s specific economic conditions, focusing on domestic growth, future prospects, and inflation management. Moving forward, experts anticipate a change in the RBI’s stance. They anticipate rate cuts starting from October 2024, with a potential for two cuts instead of the previously expected three. This revised outlook reflects the RBI’s data-driven approach and its commitment to achieving a balance between growth and inflation.

Relationship between interest rates & debt funds

Grasping the relationship between interest rates and debt funds is vital for investors. The bond yield, which signifies the return an investor gets for holding a bond till its maturity, has an inverse relationship with interest rates.

When interest rates increase, bond prices decrease, which leads to a decline in the Net Asset Value (NAV) of debt funds. On the other hand, when interest rates drop, bond prices increase, leading to a rise in the NAV of debt funds. Therefore, a rise in interest rates is generally unfavorable for mutual fund investors, particularly those investing in debt mutual funds.

It is important to remember that the movement of interest rates is not the only factor influencing the dynamics of the bond market. Other elements, such as liquidity, credit risk, and market sentiment, also have significant impacts. Furthermore, shifts in economic indicators, government policies, and international events can also affect the dynamics of the bond market.

Impact on the bond market

Experts believe that the June 7 policy was a relative non-event from the market’s perspective. Bond yields remained mostly stable within a narrow range.

Source: TradingEconomics

The market is also watching the formation of the new government, and bond yields are expected to stay range-bound.

Some experts predict that 10-year bond yields will trade below 7% in the coming months.

Regarding long-term rates, experts highlighted favorable demand/supply dynamics in the Indian bond market, apart from rate cuts. Factors such as index flows, lower bond supply, stable currency, the RBI’s commitment to 4% inflation, and anticipated rate cuts over the next year could lead to 10-year bonds trending lower in the 6.50-6.75% range over the next year.

What should debt fund investors do?

In light of the evolving interest rate scenario, debt fund investors may consider the following strategies:

Invest in long-duration funds: Investors with a one-year-plus horizon can explore long-duration funds, Gilts, or dynamic funds with higher allocations to corporate bonds, such as banking PSU funds or medium-term funds.

Bond investors can also invest in long-term G-Sec funds or long-term bond funds. Investors in long-term debt should seize the opportunity to secure the current high rates in fixed deposits for an extended period. Furthermore, in debt mutual funds, they can extend the ‘duration’ with a perspective of 18 months.

Dynamic bond funds: These funds invest over various durations. These plans adjust the tenure of the securities in their portfolio according to anticipated interest rate trends. Expecting a decrease in interest rates extends the tenure of these funds while anticipating an increase reduces it.

Maintain asset allocation: Refrain from making significant alterations to your investment portfolio influenced by short-term policy shifts. Adhere to your asset distribution plan, which should be determined by your risk acceptance and investment timeframe.

Ladder your investments: Diversify your investments across debt funds with different maturities to mitigate volatility and benefit from potential interest rate movements. Consult a financial advisor: Seek professional advice from a qualified financial advisor to assess your risk profile, choose suitable debt funds, and devise a personalized investment strategy.

Conclusion

In conclusion, debt fund investors should approach the post-RBI policy landscape with caution and a long-term perspective. While uncertainties persist, informed investment decisions guided by a thorough understanding of market dynamics and prudent strategies can help navigate the evolving interest rate scenario effectively.

By staying informed, maintaining a diversified portfolio, and seeking professional advice when needed, investors can strive to achieve their financial goals even in a changing economic environment.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- The 5 heads of income: What every taxpayer should know - July 28, 2024

- Understanding ITR: Importance, types, and deadlines - July 27, 2024

- Understanding the basics of taxation: A beginner’s guide - July 25, 2024