What’s the cost of not having a financial plan? Probably more than you think. Read on to see how structure brings peace (and profits).

Even with a steady job, it’s easy to feel unsure about your finances. A recent report found that almost half of Indian households are saving less and earning less than before. This shows how important it is to have financial planning, a process that looks closely at your finances, not just what you earn, but how you spend and save.

It helps you set goals, manage expenses, and stay ready for unexpected costs. This blog discusses the essentials of financial planning in detail to help you understand it better and get started efficiently.

What is Financial Planning

Financial planning is a process that helps you organise your money so that you can make informed decisions at every stage of life.

It involves more than just saving or investing, it’s about understanding how different parts of your finances connect and affect each other.

The Oxford Dictionary defines it as “the formulation of short-term and long-term plans in financial terms for the purposes of establishing goals for an organization to achieve, against which its actual performance can be measured.”

In simpler terms, it means having a clear plan for your money that supports your personal goals. Financial planning typically covers:

- What you earn (your income)

- What you owe (your loans)

- What you own (your assets) and

- What you aim for (your life goals).

It changes as your life changes, with a new job, major expenses, or health changes, so financial strategy stays on track.

Without planning, it’s easy to lose track or make rushed decisions.

A proper financial plan will help you meet your life goals by giving you a roadmap and helping you use your money with purpose.

Benefits of Financial Planning

Financial planning offers a structured way to take control of your money. It not only supports day-to-day financial decisions but also ensures that your long-term life objectives like owning a home, retirement, or education are achievable.

An effective financial plan will help you meet your life goals by offering the following benefits:

- You Can Set Clear Goals: It becomes easier to decide what you’re working towards like saving for a house or your child’s education and figure out how much to save for it.

- You Stay In Control Of Your Money: With a plan, you know how much you earn, spend, and save. That helps you avoid overspending or living paycheck to paycheck.

- You’re Better Prepared For Emergencies: An emergency fund and insurance keep you covered when unexpected things happen like a medical issue or job loss.

- You Can Save On Taxes: Planning helps you make the most of deductions under 80C or 80D, so you save more of what you earn.

- You Make Better Investment Choices:

Instead of guessing where to put your money, you invest based on your needs and time frame. - You Worry Less: When your finances are organised, you have fewer things to worry about every month. You know you’re on the right path.

Building a Financial Plan: Core Components to Consider

To see how financial planning works in practice, let’s take the example of Mohit, a 30-year old software developer from Pune. He earns ₹80,000 a month, lives in a rented apartment, and supports his parents.

Here’s how the main components of financial planning apply to someone like Mohit.

-

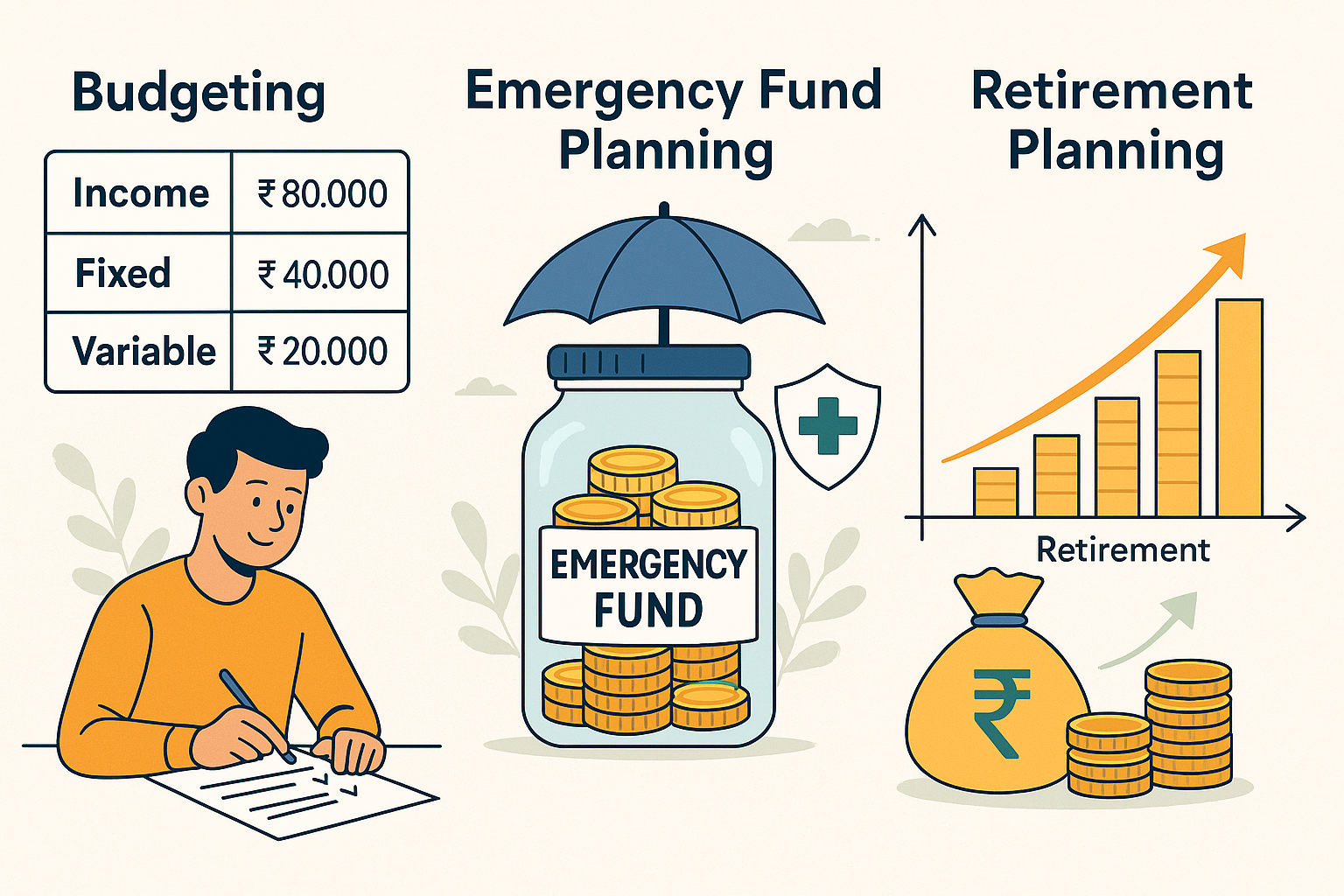

Budgeting

Budgeting lays the groundwork for every successful financial plan. It helps you track income, identify fixed and variable expenses, and figure out your monthly savings or overspending.

In Mohit’s case, his fixed expenses include rent, utilities, and internet, while his variable expenses range from food delivery to weekend outings. By simply listing his fixed expenses, he tracked everything and found that cutting down on daily coffee runs and online shopping freed up ₹20,000 per month, money that now goes into his savings and investments in SIPs in mutual funds.

-

Emergency Fund Planning

An emergency fund gives financial breathing room during sudden events like a job loss or health emergency. Ideally, this fund should cover 3–6 months of essential expenses and should be parked in safe, liquid instruments like savings accounts, liquid mutual funds, or short-term fixed deposits.

For someone like Mohit, monthly essentials total ₹40,000. He aims for a ₹2.4 lakh emergency fund, part of which he keeps in a liquid mutual fund and part in a high-interest savings account. He also holds ₹5 lakh health insurance and an ₹80 lakh term plan, considering his family’s dependence on him.

-

Goal-Based Investment Planning

Every financial plan should be linked to real-life goals both short and long term. Goal-based planning involves assigning a purpose and timeline to each financial goal, short-term (0–3 years), medium-term (3–5 years), and long-term (5+ years). The choice of instruments depends on the type of goal:

- For short-term goals: stick to safer options like recurring deposits or liquid mutual funds.

- For medium-term goals: consider balanced mutual funds, PPF, or debt funds.

- For long-term goals: use NPS, equity mutual funds, or EPF for higher returns.

Mohit has three clear goals: a laptop in 2 years, a home down payment in 4 years, and retirement savings. He uses a recurring deposit for the laptop, invests in PPF and balanced mutual funds for the home, and puts money into NPS for retirement.

-

Investment Portfolio & Rebalancing

Diversifying across equity, debt, and liquid instruments protects your wealth from market fluctuations. Over time, asset values change, so rebalancing helps maintain your intended risk level.

In Mohit’s case, his portfolio includes 60% equity mutual funds, 25% debt, and 15% liquid assets. Once a year, he checks his asset allocation and shifts money between funds when equity gets too dominant, keeping his risk profile steady.

-

Debt Management

Managing debt means keeping track of what you owe and prioritizing repayment. High-interest debts like credit card balances should be cleared first. You can use methods like the snowball (smallest first) or avalanche (highest interest first) approach, depending on what keeps you more disciplined.

Loans like education or home loans can be part of a financial plan, as long as they are repaid smartly. Avoid unnecessary consumer loans that eat into your savings.

Mohit still has a ₹3 lakh education loan at 9% interest. He focuses on clearing this quickly, while also avoiding credit card dues and resisting the urge to take on lifestyle-related EMIs.

-

Tax Planning

Tax planning is more than a once-a-year task, it’s a way to align your investments with long-term financial goals while making the most of available deductions. Instead of investing randomly at the end of the financial year, it’s more effective to spread tax-saving investments across the year and pick instruments that offer both benefits: deductions and returns.

Some commonly used options under Section 80C include Public Provident Fund (PPF), Equity-Linked Saving Schemes (ELSS), NPS and life insurance premiums. For health-related deductions, Section 80D covers premiums paid for health insurance, useful particularly if you’re covering family members too.

For someone like Mohit, who supports his elderly parents and earns ₹80,000 per month, smart tax planning became part of his financial routine. He didn’t wait till March. Instead, he invested ₹12,500 monthly in an ELSS SIP to build long-term wealth and exhaust the ₹1.5 lakh 80C limit well in time. He also claimed ₹25,000 under 80D for his family’s health insurance, which helped him save more in taxes without last-minute decisions.

What worked for him wasn’t just the savings, it was knowing his money was growing while reducing his tax liability.

-

Retirement Planning

Planning for retirement early helps build a large corpus thanks to compounding. Estimate how much you’ll need monthly in retirement, adjust for inflation, and figure out how much to invest every month to reach that goal.

Instruments like EPF, NPS, and equity mutual funds are popular for long-term retirement planning in India.

Mohit estimates that he’ll need around ₹50,000 per month post-retirement. Using a retirement calculator, he found he would need about ₹3 crore by age 60. He contributes to EPF through his employer, invests ₹5,000/month in NPS, and runs a ₹10,000/month SIP in an equity mutual fund. He revisits this plan yearly to stay on track.

Analysing and Reviewing Your Plan: Steps to Follow

Once you’ve built a financial plan, reviewing it regularly is just as important. These four checks will help you stay aligned with your goals and adjust as needed:

-

Track Your Net Worth Annually

Your net worth is the difference between what you own (assets) and what you owe (liabilities). Tracking it once a year helps you see if you’re growing financially. If your net worth isn’t improving steadily, it could point to overspending, rising debt, or underperforming investments.

You can use a simple net worth calculator to track this over time. It gives a clean view of your financial position and helps you make more informed money decisions

-

Reassess Investment Growth & Inflation Impact

Your financial goals don’t stay the same and neither does the market. Once a year, take a moment to see how your investments are performing, like equity mutual funds and stocks.

Are they growing fast enough to beat inflation? Use SIP calculators, inflation calculators, or a portfolio tracking app to get a better idea. If things are falling behind, consider increasing your contributions or adjusting your asset mix.

-

Verify Insurance Adequacy

If your family situation, income, or liabilities have changed, your insurance coverage should reflect that. Review both your term life and health insurance once a year to ensure they’re still enough.

-

Check Retirement Preparedness

It’s easy to put off retirement planning, especially when it’s years away. But checking where you stand doesn’t take long. Look at your current savings and compare it with how much you might need later.

If the gap feels wide, small adjustments now, like increasing your monthly SIP can make a big difference down the road.

Conclusion

Building a financial plan doesn’t require expert skills, just consistent effort. With the right tools and habits, your income starts working for you.

Good financial planning isn’t about perfection, but purpose. And when guided by purpose, your plan supports every goal that matters to you.

Even with a steady job, it’s easy to feel unsure about your finances. A recent report found that almost half of Indian households are saving less and earning less than before. This shows how important it is to have financial planning, a process that looks closely at your finances, not just what you earn, but how you spend and save.

It helps you set goals, manage expenses, and stay ready for unexpected costs. This blog discusses the essentials of financial planning in detail to help you understand it better and get started efficiently.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025