Table of Contents

Are you an F&O trader? If yes, then you may be affected by these F&O new rules that the SEBI-appointed expert committee may propose. Understand these rules now.

The stock market godfather- the Securities Exchange Board of India (SEBI), is all set to stir the derivatives market to safeguard the interest of retail investors. It is anticipated that the recently formed committee will propose some major reforms for the derivative market.

The futures and options (F&O) segment is growing at a surprising pace, and the regulators are totally in action to curb this pace. The proposed regulations would not be implemented too soon, but on its implementation, the impacts would be massive. Let’s explore these proposed changes and their implications.

The SEBI-F&O story

The derivatives market in India is sprawling at a crazy pace. As of January 2024, the Indian stock market is ranked as the largest derivatives market in the world in 2023 for consecutively the fifth year in terms of derivative contracts traded in the exchange.

The equity derivatives segment, mainly option trading, is one of the most attractive spaces for investors. Its notional turnover of NSE has been skyrocketing in recent years. Moreover, the total number of equity derivative contracts has increased nearly 21 times on the NSE. The trend is quite visible in the data given below:

However, this humongous growth also indicates the possibility of the growing power of big market players in fluctuating the markets more frequently.

The SEBI Chairperson, Madhabi Puri Buch , had also advised investors recently to keep a long-term outlook towards the market and cautioned against massive volatility and volume in the derivatives market.

The SEBI constituted a committee in June to look into the structure and ownership of clearing corporations. However, it also had a function regarding assessing derivatives markets due to its unprecedented growth. The measures proposed by this expert committee of SEBI would be first taken into consideration by the Secondary Market Advisory Committee or would be out in a consultation paper for public comments. Following this approval, the F&O new rules will be implemented.

Probable F&O new rules

The ad-hoc committee constituted by the SEBI is all set to propose new rules for the derivatives market, as per a report. Seizing excessive speculation in the derivatives market is the central theme behind all the measures proposed. It briefly suggests the following measures:

- Increase in the minimum F&O lot size from ₹5 lakhs to ₹20 lakhs – ₹30 lakhs.

- Weekly options will have only one expiry per week.

- Ceiling on number of strike price

- Collection of option premiums from the option buyers in the market.

- Positions in the F&O will be monitored on an intraday basis.

- Margin requirements would change closer to expiry.

Impact

Key impacts will be visible in the following areas:

Volume

The probable new rules can potentially affect the volumes of trading in the market. Due to the increase in the lot size, the capital required will be more for the option traders. Moreover, it would be tough to exit the contracts of such big lot sizes. These reasons would lead to a substantial decrease in the volume of markets.

Currently, multiple strike prices are available in the market, due to which there are frequent entry and exit positions. However, with the new rules, these strike prices would reduce and provide a less volatile market.

Weekly Expiry

Currently, the NSE has 5 index expiries per week – NIFTY Financial Services, NIFTY Mid-cap, NIFTY 50, NIFTY Bank. However, BSE only has 2 index expiries per week – S&P BSE SENSEX and S&P BSE BANKEX.

These multiple expiries create highly volatile situations in the derivative contracts of stocks of those particular sectors. Moreover, there are traders who especially trade only for the expiry and hedging their cash market positions. In such chaos, the retail investors are adversely affected.

Risk management

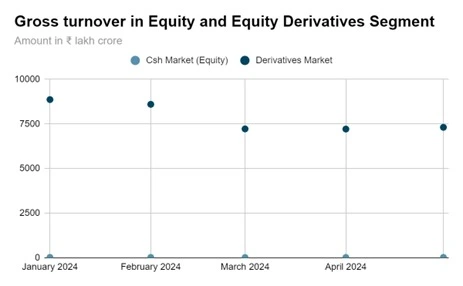

The risk in the derivatives market (specifically in NSE due to heavy volume) is evident with gross turnover in the last five months, compared to the cash markets (equity).

| Month | Cash Market (Equity) | Derivatives Market |

| January 2024 | 24.9 | 8859.6 |

| February 2024 | 24.5 | 8594.5 |

| March 2024 | 18.5 | 7218.3 |

| April 2024 | 21.2 | 7210.1 |

| May 2024 | 24.6 | 7306.6 |

Retail investors

The growing craze of the F&O market, to earn profits quickly, is harmful and increasingly, young people are falling into this trap. Experienced traders use these instruments to hedge their positions, but in this spree, retail investors face an increased risk of losing their hard-earned money.

An indirect increase in the capital requirement would restrict the entry of retail investors. The margin could be nearly 4-6 times than present, which would discourage retail investors from taking such high risks.

Brokerage firms

The small brokerage firms trading with less capital will be adversely affected by the increased lot size and decreased number of strike prices in the volume. Thus, people trading as a business or professional may face a tough time in the market if new rules are imposed.

Bombay Stock Exchanges (BSE)

Currently, BSE is operating with low volume compared to NSE. If the rule – only one weekly expiry per exchange is imposed, then it would be a golden opportunity for the BSE. Experts anticipate that the number of contracts, currently unequal for the two exchanges, will be equal shortly with this rule. It will pave a path for BSE to increase its contracts and volume.

Conclusion

The F&O new rules, which may be proposed by the expert committee, may take a long time to implement, but it will have huge implications in various aspects. The purpose behind them is to safeguard retail investors from heavy losses due to volatility in the derivatives market. However, it would adversely affect big players and professional traders.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025