Table of Contents

Weekly macroeconomic analysis on how global markets react to trade optimism, inflation signals, and policy moves as investors stay alert in an uncertain economic climate.

The week of 21 April was crucial for the Indian markets with the terror attack in Kashmir Phagaram, which happened on 22/09/2025, which claimed the lives of 25 tourists. The markets reacted to the incident, and the country’s future decisions will be crucial, with their impact on the markets being closely watched.

Further, the other markets, including the US and Europe, were trading on higher levels with the expectation of trade settlement between the US and China. In this blog, let us deep dive into the facts and what happened in the past week and do a detailed weekly macroeconomic analysis.

Weekly macroeconomic analysis on Indian Market Update

The Indian markets faced a crucial week, with another ahead, as the government responds to the Pahalgam attack. Additionally, the recent steps taken by both governments have escalated trade tensions between India and Pakistan.

In response to the attack, India suspended the 1970 Indus Water Treaty,which regulated the river’s flow to Pakistan . Around 80% of Pakistan’s agricultural water needs depend on this flow. The suspension of the treaty angered Pakistan further. In retaliation, Pakistan imposed a partial airspace ban on Indian flights, which is expected to impact India.

Due to this, the markets corrected. On 23 April 2025, the Pakistani stock market KSE 100 fell by 2,000 points, but the Indian market, specifically Nifty, was not impacted. However, after two days, on Friday, 25 April 2025, the Indian market fell from 24,366 to 23,849 points , but it started recovering after the fall on the same day and closed in the 23,989 range. However, looking at the the financial market insights, FIIs remained net buyers for the week, making a positive buying of Rs.14,534 crores.

Source: Tradingview

India’s core sector production saw a year-on-year increase of 3.8% in March 2025 , the biggest gain in two months. The rise was led mostly by major rises in cement, steel, and electricity production.

Sectoral Performance

- Cement Production: Rose by 11.6% from March 2024.

- Steel Production: Increased by 7.1% year-on-year.

- Electricity Generation: Increased by 6.2%, higher than 3.6% in February, due to the onset of summer in most areas.

- Fertilizers: Growth eased to 8.8% from 10.2% in February due to a high base effect and higher inventory levels last year.

- Refinery Products: Growth eased to 0.2% from 0.8%.

- Coal: Production fell by 1.6%, down slightly from 1.7% in February.

- Natural Gas: Production fell by 12.7%, a steeper fall than the 6% decline in February.

- Crude Oil: Production fell by 1.9%, as international prices were lower.

US Market Update

During the week, US stock markets gained, with the Nasdaq Composite up by 9.4% . This rise was majorly due to hopes of a settlement in the tariff war, with all countries coming together for trade negotiations. Also, the specific part is that China has agreed to partake in these trade negotiations, which gave a positive signal, and this sentiment contributed to the rise in the US markets for the week.

Source: Tradingview

The data for home sales was also released, where US home sales fell to their slowest pace since 2009. The sales of previously owned homes in March dropped by 5.9% from February to 4.02 million. This is mainly due to higher mortgage rates and the ongoing uncertainty of a recession.

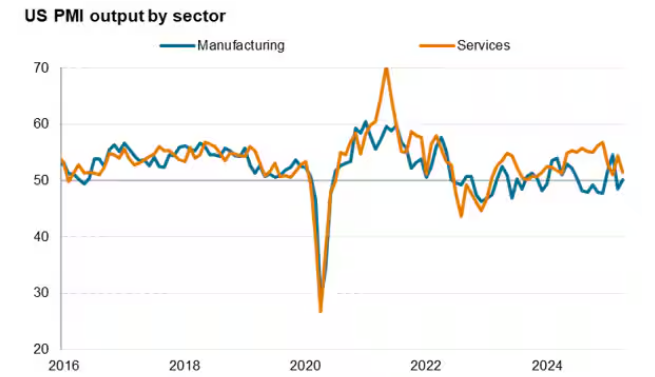

The S&P Global US PMI Composite Output Index declined from 53.5 in March to 51.2 in April. The decline indicates a slowdown in activity growth to a 16-month low from the three-month high of March.

Source: S&P Global

The US 10-year Treasury yields dropped from 4.43 to 4.24. This was mainly due to the bond price rise and the demand for safe assets like bonds among investors.

Source: Tradingeconomics

Japan Market Update

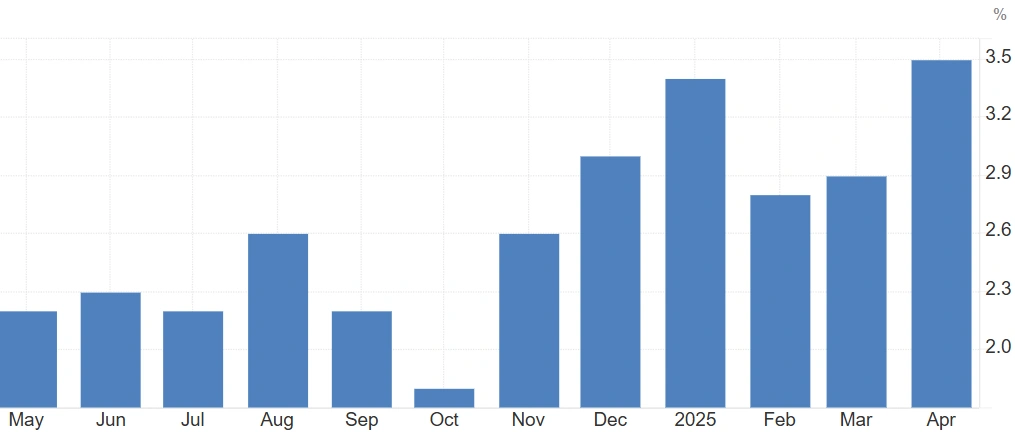

During the week, the CPI (Consumer Price Index) data was released for Japan. The CPI of Japan was up by 3.4% , which was above the forecast of 3.2%. This was mainly due to rising food costs, and it hit a two-year peak. Also, the BOJ (Bank of Japan) policy meeting is going to be held between 30 April 2025 and 1 May 2025 for the economic policy analysis and interest rate decisions.

Due to the rising inflation and US tariff tensions, it is expected that the bank may keep the rates unchanged at 0.5%.

Source: Tradingeconomics

Europe Markets Update

The European markets also surged, with the STOXX 600 index up by 3.58%, rising from 502 to 520 during the week. This was mainly due to President Trump saying that the tariffs for countries will be reduced but not ended, and also because negotiations with China are expected to happen.

Source: Tradingview

The German government stated on Thursday that it now forecasts the economy to grow to zero in 2025. They had previously anticipated that the economy would grow 0.3% this year, earlier in January. Economy Minister Robert Habeck made this announcement while speaking in Berlin, indicating that another difficult year awaits Germany. The retail sales in Britain increased by 1.6% in the first quarter, marking its best four-year performance. During March alone, sales increased by 0.4%, against expectations for a fall. This healthy shopping activity contributed a small bump of 0.08 percentage points to the overall economic growth for the UK’s first quarter in 2025.

China Market Update

China’s highest authorities, the Politburo, 24 top leaders headed by President Xi Jinping announced on Friday that they are preparing contingency measures to face any unforeseen issues from overseas. They added that they would roll out fresh financial instruments and assistance programs to support technology, stimulate consumer purchasing, and foster trade. China is patient and cautious with its economic policy, even though the U.S. has significantly increased tariffs on Chinese goods.

Commodity Update

Let us have a look at what happened in the commodity markets during the week:Gold: During the week, on Tuesday, gold once again made a new high, where MCX gold reached around 99,336 . The major reason being that gold acts as a safe asset in times of uncertainty, which is happening right now due to trade wars and recession fears.

Source: Tradingview

Crude Oil: Crude oil imports declined to 5.6 million barrels per day last week, 412,000 barrels per day below the previous week. For the last month, imports were averaging 6.1 million barrels per day, a decline of 6.8% compared to last year at the same time. At the same time, crude oil inventories increased by 0.2 million barrels but are still around 5% below the five-year average.

Natural Gas: The level of natural gas in storage stood at 1,934 billion cubic feet (Bcf), up by 88 Bcf from the previous week. Nevertheless, storage remains 478 Bcf less than the equivalent period last year and 44 Bcf less than the five-year average. By region, the East region held another 5 Bcf, the Midwest expanded by 23 Bcf, the Mountain region rose by 5 Bcf, the Pacific rose by 8 Bcf, and the South Central region increased by 47 Bcf.

Major Events in Coming Week

| Date | Country | Event |

| 28-Apr-25 | India | IIP (Index of Industrial Production) data |

| 01-May-25 | Japan | BOJ Interest Rate Decision |

| 02-May-25 | India | Manufacturing PMI |

Conclusion

Based on the overall global economic trends and macroeconomic indicators, the outlook still seems uncertain with the rising tensions of military operations between India and Pakistan. If this happens, a correction could also be seen in the markets. On the global end, the tariff issue has slightly calmed down but is not fully resolved, with countries trying to negotiate on the same. So, the recession risk still exists, and investors need to be cautious before making any investment decision. To invest in stocks or mutual funds, various online platforms are available today where one can do proper research and then make an investment decision.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Crypto vs Equity Investing: What’s Right for Beginners in 2025? - July 1, 2025

- How I Doubled My Portfolio: Investment Story Beyond Stock Recommendations in India - June 24, 2025

- Values-Based Budgeting: What It Is & Why It Works - June 24, 2025