Table of Contents

Why is the Indian stock market falling today? Indian stock markets have been facing immense turmoil in the past few months. The equity market has been highly volatile since October 2024, due to various reasons. This blog post will explore the potential factors contributing to the recent market downturn.

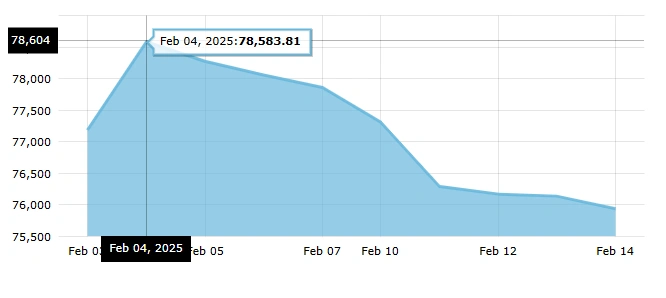

To add to the chaos, Sensex and NIFTY 50 have been tanking for 8 straight sessions since 4th February 2025.

Certainly, investors must be interested in understanding if this is normal, or does history has something to say about this volatility. You are not the only one looking for answers, typically most investors remain puzzled when the markets are going down. Understandably, so!

With the stock markets in India taking a tumble, it’s time to uncover the real reasons behind the plunge.

So, in this blog, we will uncover the meaning of a stock market crash, past stock market crashes that took the limelight, the reasons attached to them, and an overall perspective on why the stock market is down this week!

What is a stock market crash?

A stock market crash takes place when there is a sudden, rapid, and dramatic fall in the stock prices of the majority of stocks in the stock market. The fall usually occurs when investors are rushing to sell off their stocks and holdings.

Although, there is no particular measure of a downfall. Typically, a stock market decline in double-digits over a period of days or weeks is referred to as a stock market crash.

But wait, don’t confuse it with a Bear market. A bear market is when the stock prices persistently fall by over 20% from their previous peaks! These can last for months or even years.

Alternatively, a market is said to be in a ‘correction’ when there is a decline of 10-20% and it lasts a few days, weeks, or months.

Most stock market crashes are short-term and bring with them sudden abrupt falls in stock prices that take away investor’s money and bring about a panic state in the market! To understand a stock market crash, let’s look at how they took place in the past.

Historical Stock Market Crashes in India

Harshad Mehta Scam (1992)

Popularly known as the ‘Big Bull’ of the stock market, Harshad Mehta, an Indian Businessman and investor, was engaged in a massive financial fraud in Indian history. He manipulated the market using loopholes in the banking and financial system that existed at the time, siphoning off more than ₹4,000 Crores of investor’s wealth from the Indian stock market.

So what exactly happened? Mehta took advantage of the loopholes in the banking system, exploited the bank’s practices of issuing Bank Receipts as collateral for short-term loans, convinced banks to issue fake BRs, and used these to ultimately obtain funds from other banks.

In this way, he embezzled money from banks, and diverted it into the stock market, influencing the market to follow him, causing artificial inflation of some undervalued stocks.

| Stock name | Price before the scam | Price after the scam |

| Associated Cement Company (ACC) ltd | ₹200 | ₹9000 |

| Videocon ltd. | ₹45 | ₹2000 |

| Sterlite Industries ltd. | ₹30 | ₹1500 |

This led to a 40% fall in the stock market!

2008 Financial Crisis

Although this wasn’t the only reason, following the collapse of Lehman Brothers, an American Investment Bank, the entire world faced the brunt of it in the form of a global financial crisis.

The housing market faced a bubble in 2007, to take advantage of this US Banks started lending even to people who could not realistically afford them. As people started defaulting, banks and lending institutions started facing financial difficulties. One thing led to another, and boom!

Gradually, foreign financial institutions started withdrawing their investments, which led to a massive stock market crash, and economic slowdown. From January 2008 to November 2008, the Sensex was down by 56%.

2020 COVID Market Crash

The Coronavirus did not just impact the health of Indian and Global citizens, it also brought with it a severe economic crisis, with a total economic shutdown.

Dow Jones witnessed its worst single-day fall on Monday, March 9th, 2020 when it crashed by 7.79%. And, then again on March 12th, with a 9.9% fall followed by another drop of 12.9% on March 16th. Consequently, India faced a massive fall of around 40% in its major stock indices’ values.

The severity of the pandemic left tremors all around the world, leading to an economic recession.

Now, let’s look at the current market situation!

Why is the Indian Stock Market Falling Today?

The Indian equity market is currently navigating a period of volatility due to global economic uncertainties and domestic factors. The Indian stock market remains under pressure. There is a continuous downtrend in the Sensex and Nifty.

But the actual bloodshed seems to be happening in small and midcap segments. Small and mid-cap stocks are facing some challenges, but long-term investors may find value in these segments due to potential market corrections. The Indian markets are facing sharp corrections in small and midcap sections. Experts have constantly tried to spread caution on the stretched valuations in small and midcap sectors, but investors have ignored the warning!

The NIFTY Midcap has tanked 18.9% from their highs, while the Small Cap Index has plunged around 22%.

The Small cap and Mid Cap sectors are facing heavy selling pressures amidst Trump imposed tariffs and fueled by expert opinions on not holding small and midcap stocks right now!

Now, what are the reasons for this downturn?

Reasons for Stock Market Fall

Foreign Institutional Investors selling

Foreign investors are withdrawing their shares quite aggressively. By the end of the 18th February 2025 session FIIs have sold around ₹28,000 Crores of investments in the month.

Suggestive reasons for this include sky-high valuations of small and mid-cap stocks, an anticipated slowdown in economic growth, and also a sharp drop in quarterly corporate earnings. This has made foreign investors cautious and they want to take their money out to safeguard themselves.

This aggressive selling has in turn led to a stock market fall!

Weakening Indian Rupee

The Rupee has been on a downward trend against Dollar since the beginning of 2025. It fell past the ₹86 mark in January and hit a record low at ₹87.95. Major contributors to this downfall are high crude oil prices, policy shifts by the RBI and the continuous aggressive selling by FIIs.

The weakened Indian Rupee makes Indian investments less attractive. This further aggravates selling in the Indian stock market, leading to a downfall.

Sluggish Indian Economy

India is predicted to have sluggish economic growth owing to global risks. India’s GDP is forecasted to grow at a lower rate of 6.4% to 6.6%, nearly 2% lower than the previous year.

There is a weakness in the demand side of the economy, and consumption is expected to be lower this year. Even though the government has been taking measures such as tax cuts in the latest Union Budget, rate cuts, etc to boost consumption, there is still a lot of uncertainty.

Well, when economic growth slows, consumer demand drops, businesses struggle to maintain profitability, and market sentiment turns cautious. The ripple effect is seen in falling corporate earnings, reduced investments, and higher uncertainty.

Trump’s tariffs are a big question mark. The high tariffs already announced on steel imports are going to affect Indian exports.

The slowdown is in turn expected to impact the stock market. Now, how can investors protect themselves from this downturn?

Conclusion

It is quite likely that a stock market downturn can instill panic in you as an investor. With unpredictability all around, investors need to stay calm. Here are some tips you can follow

- Track the market regularly to stay updated on the major indices’ performance.

- Maintain a long-term perspective as time can smooth out market fluctuations.

- Reassess your asset allocation to reduce investment risk. Stocks are the most volatile in the short term but also perform well in the long term. So keep this in mind, and reassess your investment allocations.

- Adjust your savings and spending depending on the market volatility to keep them on the right track!

Remember, it’s crucial to stay mindful and focus on the long term for optimal results!

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Make in India 2.0: How Manufacturing Is Reshaping Market Sentiment - December 13, 2025

- Real Estate Boom : Why Tier-2 Cities Are Attracting Big Investors - December 12, 2025

- India’s GDP Surge 2025: What the New Growth Numbers Mean for Markets - December 9, 2025