Table of Contents

Wondering if gold or silver is the right investment for you now? Let’s find out.

Introduction

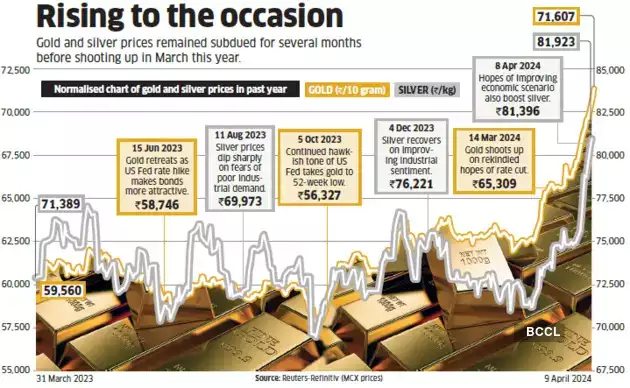

Wondering if investing in gold or silver is the right choice for you now? Let’s find out. In a surprising turn of events, both gold and silver have delivered strong returns so far in 2024. As of April, investors have seen impressive gold vs silver returns, with gold offering a 15% return, while silver gained 13%, despite falling from its mid-April peaks.

Source: The Economic Times

Typically, gold is seen as a safe haven for parking funds during uncertain times, while stocks are said to thrive when economic conditions are good. But what explains today’s topsy-turvy market — an “everything rally” with stocks and precious metals on fire and even real estate seeing a bull run?

Which brings us to the question: Should investors add these commodities to their portfolios now? Let’s dig deeper.

Why are gold and silver prices rising?

Gold prices surged an impressive 14% in 2023, significantly outperforming silver’s gains of 8%. The year to date has been incredible for gold and silver as well.

Here are several factors that contributed to this rally:

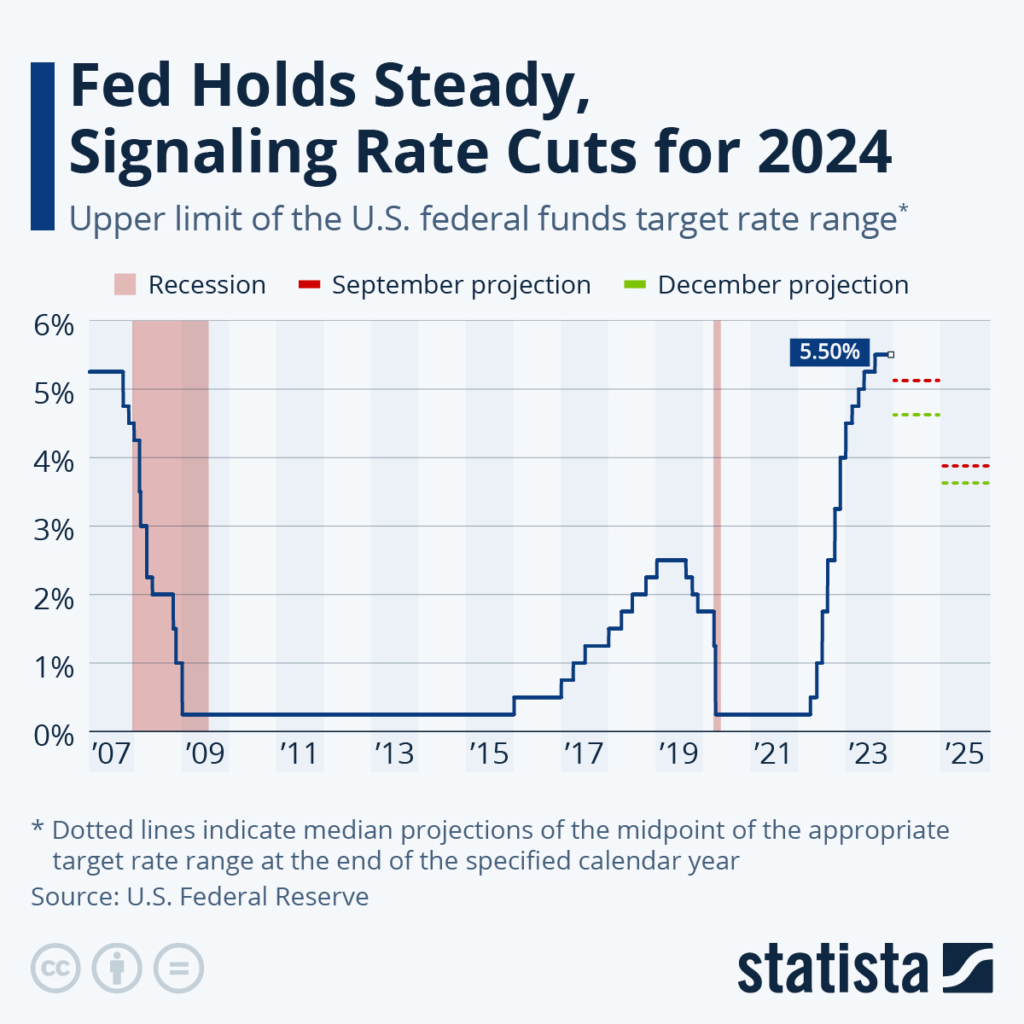

- Federal Reserve policy change: The market expects that there will be a drop in US interest rates soon. Due to this reason, gold and silver became more attractive since it does not bear interest, unlike bonds.

Source: Statista

- Geo-political tensions: Investors are turning to safe-haven assets such as gold and silver because geo-political tensions are escalating worldwide, especially in the Middle East (Iran- Israel, Russia-Ukraine) regions. Since gold and silver are known for being stable during uncertain times, people are buying these assets more.

- Buying spree by central banks: According to reports, some countries like China are diversifying away from the US dollar and increasing gold holdings, following the freezing of Russia’s reserves by the US and Europe. This de-dollarization trend is a significant factor in the gold price rise.

Source: Bloomberg

- Election jitters: General elections are approaching in many large economies, and this has introduced another layer of doubt into people’s minds; thereby making gold and silver an even better asset for portfolio diversification.

- Rupee depreciation against the Dollar: The Indian currency weakened vis-a-vis the dollar, increasing import costs for precious metals and pushing up local rates.

Finally, a combination of factors, including potential US rate cuts, geopolitical tensions, central bank buying, and a weaker rupee in India, all are contributing to a significant increase in gold and silver prices.

Should i invest in gold or silver?

Gold and silver have been prized possessions for millennia, and for good reason.

Here’s a detailed breakdown of the advantages of investing in these precious metals

Hedge against inflation and recession

Gold and silver are viewed as “safe haven” assets since, unlike stocks and bonds that can be affected by economic downturns, they either retain their value or increase it.

When inflation erodes the buying power of currencies, they serve as a store of wealth because the worth of gold and silver usually stays constant.

Diversification of portfolio

The price fluctuations in gold have minimal association with other investment assets like stocks or bonds. Therefore, adding them to your investment portfolio aids in diversifying risk.

Even when the rest of the assets decline sharply, these two may stay flat, thereby lowering overall portfolio volatility.

Tangible asset

Gold and silver are physical assets, unlike stocks and bonds, which are stored in digital form. They can be held physically, a fact that may attract certain investors who like to have control over what they invest in.

Industrial demand for silver

Silver has significant industrial uses in areas such as electronics and solar power, apart from being a precious metal. This dual demand for silver provides additional price support.

Is it the right time to invest?

Gold and silver, without a doubt, have the potential to yield inflation-adjusted returns. Therefore, experts advise you to consider investing in gold and silver as part of your investment portfolio.

When it comes to asset allocation, risk should be balanced against reward. Historically, gold vs silver returns have shown a counter-cyclical pattern, performing well when equities are struggling and vice versa. Adding gold and silver to your investment portfolio can enhance stability during market volatility.

Another important factor is that over centuries, gold and silver have been able to hold their value, making them an appropriate tool for long-term wealth preservation. While their prices may vary in the short term, the lasting value of these metals can safeguard your portfolio against long-term market cycles.

There are many ways to include these precious metals in your investment portfolios, such as buying physical bars or coins, or investing in gold and silver through Exchange Traded Funds (ETFs) or mutual funds that have exposure to these assets.

The perfect balance of gold and silver in your investment portfolio is determined by your risk tolerance, investment objectives, and overall asset distribution.

How much should you invest?

The inability to get immediate cash flows leaves many investors in doubt as to how much to invest in gold or silver, considering the gold vs silver returns. Unlike shares that can be bought and sold at the click of a button, purchasing or selling gold and silver cannot be rushed into quickly.

Experts recommend that gold investment should ideally account for only 5-10% of the portfolio to balance potential gold vs silver returns.

Hence, according to your short-term and long-term objectives, you need to choose the form of investment in gold. Physical gold may be the most appropriate option for those who seek wealth preservation, while digital gold or gold ETFs might offer greater liquidity and cost-effectiveness.

But ultimately, it all depends on investors’ risk appetite, investment goals, and expected gold vs silver returns.

Final thoughts

To sum up, the recent rally in gold and silver prices has a lot to do with probable US rate cuts, geo-political tensions, and central bank purchases alongside rupee depreciation in India. Typically considered to be safe-haven assets, gold vs silver returns provide protection against inflation and offer diversification opportunities for investors’ portfolios during an economic slowdown or recession.

Nevertheless, whether or not one should invest will depend on their risk appetite; what their goals are and the options available.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- How I Doubled My Portfolio: Investment Story Beyond Stock Recommendations in India - June 24, 2025

- Values-Based Budgeting: What It Is & Why It Works - June 24, 2025

- Gold Investment 2025: Is Gold Still a Safe Haven? - June 16, 2025