Table of Contents

Understand the price action of the FMCG sector prior to the 2025 budget also look at various post budget scenarios.

With the budget 2025 about to be announced in a few days, analysts are focusing on one key sector – Fast Moving Consumer Goods (FMCG). The direction of FMCG stocks acts as a barometer of how much disposable income the public has. Since rising incomes lead to rising discretionary spending. If the market participants feel that the provisions of the budget are aimed at increasing disposable income with the public, then they will invest in FMCG stocks and vice versa.

The Nifty FMCG index is used to track the FMCG stocks. This blog examines the charts and price behavior of the Nifty FMCG index prior to the budget.

Nifty FMCG Index: Returns

| Time Horizon | % Return |

| 1-week | -0.02% |

| 1-month | -1.77% |

| 3-month | -6.35% |

| 6-month | -11.31% |

Source: NSE

The FMCG index has performed poorly in the last few months, the reason behind this poor performance is a slowdown in discretionary spending in urban areas due to elevated interest rates and narrowing margins for FMCG companies due to high inflation in raw materials.

Technical Analysis of FMCG Index

Source: Tradingview (Nifty FMCG Index, Weekly chart, as on Jan 29, 2025)

The weekly chart of the Nifty FMCG index, which displays the price data since 2018, shows that the FMCG index is in a strong uptrend. The reason behind this is investors consider FMCG as a defensive sector, meaning that even in the worst of economic conditions, people will not stop buying products like biscuits, soaps, etc. Hence, investors keep adding these companies to their portfolios.

Now, let us take a closer look at the price action of the FMCG index.

Source: Tradingview (Nifty FMCG Index, Daily chart, 50 and 200 DEMA, as on Jan 29, 2025)

On the daily chart, Nifty FMCG index is showing the following signals:

- The index has slipped below its 200-day EMA (blue line), suggesting bearishness.

- The 50-day EMA (red line) has slipped below the 200-day EMA (blue line), forming the death cross that indicates bearish price behavior.

- The FMCG index which is trading at around 54,900 levels as of January 29, 2025, has its heading towards its next support range of 54,000 – 54,500.

These indicate that the FMCG index is under significant pressure, and it is closing in a major support zone of 54,000-54,500. Support and Resistance zones are those levels from where the price either consolidated or reversed in the past.

Let us look at what technical signals traders and investors watch out for during and after the budget that can give insights into the future price action of the FMCG index.

Budget impact

There can be multiple outcomes of the budget that are:

- Good budget: The budget 2025 will be considered good for the FMCG sector when it is aimed at increasing the disposable income in the hands of the general public. This can be done through tax cuts, subsidies, and job creation. In that scenario, the following technical signals will act as confirmation:

- The FMCG index does not fall below its immediate support zone of 54,000 – 54,500. Any consolidation and reversal from this zone will be a positive signal.

- The index decisively moved above its 200-day EMA (blue line) on the daily chart.

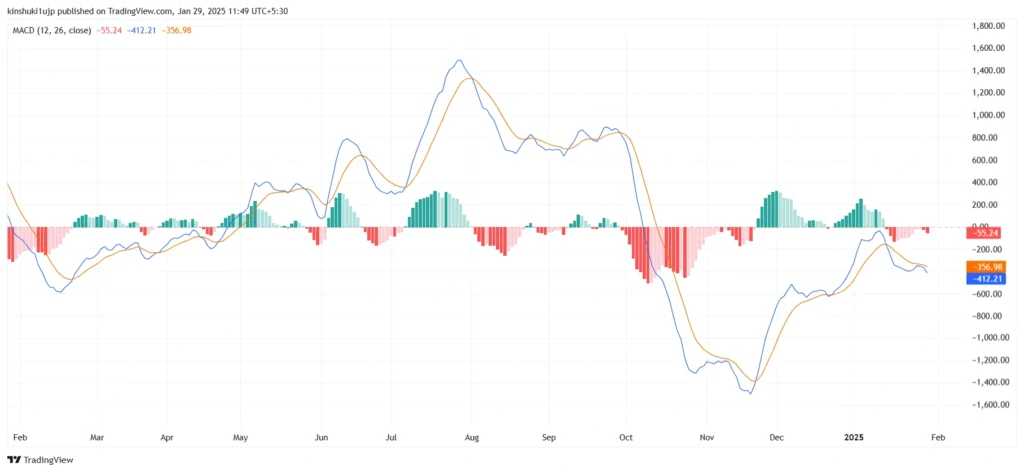

- Another confirmation can be from the MACD indicator. Currently, the MACD indicator for the FMCG index is below its 0 value, but at the same time, it is heading toward the zero line after creating a low, which indicates that the strength of the bearish move is weakening.

If this indicator moves above the zero line, that can be confirmation of the reversal of the bearish trend.

Source: Tradingview (Nifty FMCG Index, Daily timeframe, MACD index, as on Jan 29, 2025)

This will imply that due to increased spending power with the public, they will spend more on FMCG items, and thus, the profitability of FMCG companies will increase.

- Bad budget: Market participants can consider the budget 2025 bad for the FMCG sector if it does not contain any provisions to enhance the disposable incomes of the public or if it has some provisions that lower the amount of disposable income, such as a tax increase. In this scenario, market participants should look for these price action signals for confirmation:

- The index breaks below its immediate support zone of 54,000 – 54,500. In that case, the next support zone to watch out for will be in the zone of 52,400 – 52,800.

Source: Tradingview (Nifty FMCG Index, Daily chart, as on Jan 29, 2025)

This would imply that the decreased spending power will lead to lesser spending on FMCG products. Thus, the profitability of FMCG companies will most likely decrease.

- Neutral Budget – A neutral budget implies that market participants believe that the provisions of the budget are neither too bearish nor too bullish for the FMCG sectors. In that case, the index would most likely keep moving in a sideways direction, and market participants would wait for other signals like interest rate cuts, inflation print, etc, to gauge the direction of FMCG space.

Expectations for FMCG Sector in 2025 budget

Industry bodies are expecting some provisions from the 2025 budget to increase spending in the rural and urban areas. These provisions include tax cuts, tax exemptions and job creation measures.

One FMCG company that is on the analyst’s radar is ITC. Because the budget 2025 is expected to increase taxes on tobacco products. No major changes around taxes on tobacco have been introduced in the past few budgets. So, this time, there can be a substantial GST hike for tobacco products.

Conclusion

The 2025 union budget will be a key deciding factor for the future price direction of the FMCG companies. How investors have perceived the outcome of the budget will be visible from the movement of the FMCG index. Always remember that markets can be highly volatile on the budget day and a few weeks after that so trading must be done with caution.

DISCLAIMER: This article is not meant to be giving financial advice. Please seek a registered financial advisor for any investments.

- Weekly Nifty 50 Trading Strategies and Technical Outlook - June 11, 2025

- Nifty 50 Trading Strategies and Technical Analysis - May 26, 2025

- Weekly Nifty 50 Technical Analysis: Key Trading Strategies - April 30, 2025